Favorable weather keeps market in check.

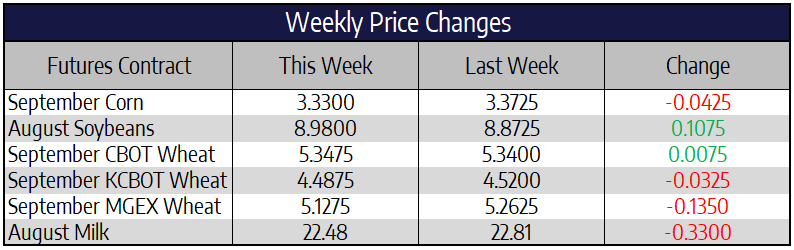

September corn futures were 4-1/4 cents lower this week to close at 333. December futures were 5 cents lower this week to close at 339-3/4. Rains fell across a large portion of the corn belt, specifically Iowa and Illinois, that were in need of precipitation early this week. Dryness still remains an issue in a good portion of Indiana and Ohio where rains have been spotty at best in the last month. But as a whole favorable U.S. growing conditions seem to be the main storyline for this corn market. Unless there is a shift to more threatening weather into late July/ early August short-term upside in the corn market looks to be limited.

China has booked 154 million bushels of corn for the 2020/21 marketing year in just the past week. This is the greatest volume of corn China has forward contracted from the U.S. and is the second-highest import purchase on record. The reason this impressive booking is not mustering a rally in the corn market is the fear of cancellations down the line. If trade tensions continue to rise between the two countries, the risk of cancellations increases greatly. Even with these recent corn purchases, China continues to hold auctions of its state-held corn reserves. Another 4 million tons were auctioned this week bringing this year’s total volume auctioned north of the 30-million-ton mark.

Soybeans rally on continued China buying.

August soybean futures were 10-3/4 cents higher this week to close at 898. November futures were 4-1/4 cents higher this week to close at 895. The U.S. dollar has traded lower here in the month of July and is back near its recent lows. A lower U.S. dollar will help soybean exports which continue to rise. Current U.S. new crop soybean sales total 77.2 million bushels, this is lower than the 5-year average but up a whopping 181% from last year’s volume. The majority of these sales are to China. China’s imports of soybeans in June hit an all-time monthly record of 11.1 million tons. Monster shipments of soybeans out of Brazil account for a large chunk of the record import total.

The U.S. soybean crop looks to be off to a great start around the country. Just 7% of the U.S. soybean crop is rated Poor/ Very Poor. Great looking crops and an extended outlook for heat and at least some moisture has weighed on futures all week. “Unknown” again bought US.. soybeans on Friday, booking 126,000 metric tons. There is a very good chance this buyer was China. China has been the primary buyer of soybeans as of late, but almost all purchases have been for new crop beans which is limiting market reaction. All of these large bookings and deliveries of soybeans into China has some traders fearful that they are close to fulfilling its soybean import quota.

Wheat mixed this week.

September Chicago wheat futures were 3/4 of a cent higher this week to close at 534-3/4. September KC wheat futures were 3-1/4 cents lower to close at 448-3/4. September MPLS spring wheat futures were 13-1/2 cents lower this week to close at 512-3/4. Traders were disappointed this week with the lack of confirmation that China was a buyer of soft red winter wheat from the U.S. This, along with an overbought technical picture and continued harvest pressure, closed front-month Chicago wheat 15 cents off of its weekly high. Thursday was a rough day for the wheat market, closing some 2.8% lower on the day. Export sales came in stronger than expected this week but failed to bring much buying support. A close below 545 for September wheat is a negative development for the market. With front-month futures above important moving averages backfill type action can be expected in the coming weeks. Get current with sales if not already.

Block Prices Continue Downswing

Cheese prices in the spot trade look to be continuing the correction of the spread between block prices and barrel prices. With blocks hitting an astounding $3.00/lb to start the week the price difference between blocks and barrels hit a new record. Immediately afterward we saw block prices drop drastically to $2.66/lb. This has helped alleviate the spread. Barrels actually held sturdy, rising slightly as blocks fell. Whey prices look to be trying to break higher after briefly trading below $0.30/lb for the first time since 2019. Butter and cheese were quiet this week with butter finishing unchanged and powder finishing at the pivotal price point of $1.00/lb that has been acting as support.

The July to December average for 2020 pulled back slightly this week going from over $20.00 to finish at $19.83. A continuation of lower block prices seems likely as the market went so high so quickly. It may be healthy for the market to see the spread between blocks and barrels stabilize. The biggest factor will be whether or not the price trend will continue lower once the spread has been corrected.