Corn moves higher this week.

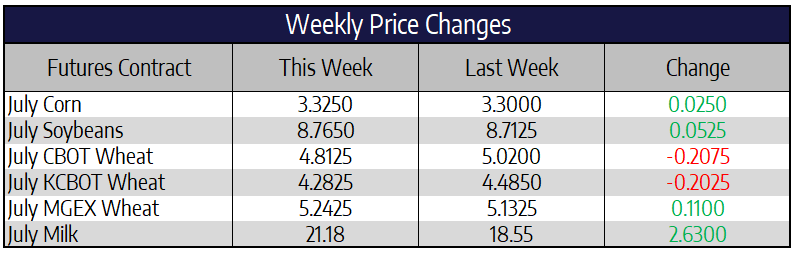

July corn futures held on to late week strength to close 2-1/2 cents higher this week at 332-1/2. December futures rose 2-1/4 cents this week settling at 345-1/4. Those in the western corn belt picked up a healthy shot of precipitation late Thursday night into Friday with weekend forecasts calling for more of the same. Those in the eastern corn belt who could really use some rain will likely still be wishing for some rain come early next week. Chances for more than an inch of rain falling in the eastern corn belt within the next seven days lies between 20% and 50%. Averaged across Illinois, Indiana and Ohio, the first 19 days of June have been the eighth driest in the last 128 years. With above normal temperatures and humidity levels falling very low this weekend in those same states, crop stress will continue to show. The stark differences in the condition of this corn crop between the eastern and western belts looks to be separating farther in the coming week.

Chinese corn prices are at their highest levels since 2015, this comes after multiple weeks of large quantities of corn being auctioned from Chinese state reserves. Rumors also circulated late yesterday that Chinese buyers were inquiring about US ethanol. Separating from all the noise of trade talks and weather the corn market had a strong week technically. A test and close well off its weekly low and above both the 10- and 20-day moving averages bodes well for the corn market heading into the weekend. For now, the trend higher continues with a vital stage of the growing season left in front of us.

Soybeans close higher for fourth week in a row.

July soybeans continued their trend higher this week rallying 5-1/4 cents to close at 876-1/2. November soybeans posted a late week rally to close a penny higher this week at 880-3/4. The trade spat between the US and China continues to grab the headlines of the soybean market much like they have for over two years now. The US and China held meetings this week in Hawaii, reports out of the meetings vary on which source you choose to follow. Bloomberg is reporting that China has said it will accelerate US farm purchases as it continues to pledge from the phase 1 commitments. Other sources reported topics such as COVID-19, handling of Hong Kong protests and human rights dominated and soured the overall tone of the meetings. Whichever source you choose to follow the ongoing conversation between the two nations is better than no conversation at all.

Sales of US soybeans to China for 2020/2021 are starting to resemble old times once again. As of June 11th, sales totaled 3.05 million metric tons for delivery starting in September of 2020. This is a six year high for the middle of June looking ahead to the next marketing year. Flash sales this week let us know another 390,000 tons will be added to this total on next Thursday’s export sales report. These sales however must be taken with a grain of salt as they can be cancelled just as easily as they are placed within the next 15 months.

Wheat moves lower this week.

July Chicago wheat was 20-3/4 cents lower this week to close at 481-1/4. July Kansas City wheat was 20-1/4 cents lower this week to close at 428-1/4. July Minneapolis Spring wheat was 11 cents higher this week to close at 524-1/4. Seasonal harvest pressure was thought to shoulder much of the blame for wheat prices this week. Selling pressure drove KC futures to their lowest levels since September 9th this week. Expansion in the dryness of the Dakotas and northern prairies helped prop up spring wheat futures this week. Winter wheat remains in a steep downtrend given this week’s price action. Promise of a bottom seemed to rear its head as futures tested and closed above the 200-week moving average on a Chicago continuous chart. If support fails here a test of Septembers lows near the 450 mark looks inevitable.

June & July Milk Break $21.00 Level

The price action in the spot market this week was positive in every market other than butter. The biggest driver of the market continues to be cheese as blocks rose a tremendous 15 cents on Friday to $2.65/lb. Barrel prices have been trading lower on the week but the price hasn’t been falling out of bed like the market was predicting. The whey market has been stubborn struggling to get more than a few cents away from the $0.30/lb level. It does look like a potential double bottom has formed and the whey market may travel higher next week. Non-fat powder has been slow to rise in comparison to the fat complex. But it has been steady and was able to finish above the psychological level of $1.00/lb and could see additional upside higher. Butter prices look to be in a consolidation pattern and could follow cheese higher if the rally continues.

The July to December average finished at $16.84 last week and has rallied over a dollar higher to $18.28 to end the week. Futures have been pricing in a massive discount to cheese and with cheese prices staying elevated it looks like futures are having their hands forced to push the market higher. June and July both traded above $21.00 this week at levels above last years highs. The fourth quarter of 2020 continues to price in close to a 70 cent decline in the price of spot cheese as they are skeptical on how long these cheese prices can last.