Corn looks towards recovery.

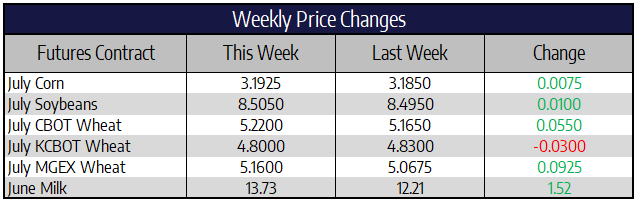

July corn was ¾ of a cent higher this week to close at 319-1/4. December corn was a penny lower to close at 335-3/4 this week. China bought 27 million bushels of US corn Thursday morning. This large purchase renewed hope China is going to honor their phase one trade agreement with the US. China stated last week they were looking to sure up their state stockpiles. This is a step in the right direction for trade relations. Corn demand needs all the help it can get with ethanol demand crawling back from record lows. Crude up over 30% this week should help rejuvenate the ethanol industry as a number of states start to open up and get back to some form of normalcy as far as gasoline demand is concerned.

Freeze warnings are in place tonight stretching across the entire Eastern corn belt into most of Illinois, Iowa, Minnesota and Wisconsin. Lows in the upper 20s are forecast to extend as far south as Kentucky on Saturday morning. Seasonally the corn market is entering a time of the year where prices should be beginning to trend higher. With continuous corn futures chart closing above the 20-day moving average on Friday and seasonal charts pointing to higher trending prices speculators will most likely be hesitant to add short positions in the coming weeks.

Soybeans higher this week.

July soybeans were a penny higher this week to close at 850-1/2. November soybeans were a ½ cent higher this week to close at 855-1/2. Brazil exported a record 16.3 million tons of soybeans in April, 32% more than the prior monthly record set in May 2018. Some 72% of Brazil’s exported beans in April were sent to China. For comparison the US shipped a mere 2.57 million tons of soybeans in March. Despite buying literal boatloads of Brazilian beans, domestic soybean prices in China continue to climb. Prices shot above 2012 prices last week and have continued to climb as of late. The jump in prices is likely due to both increased demand from a recovering hog herd following ASF as well as global supply chain disruptions amidst COVID-19. With Brazilian harvest mostly complete China may need to look to the US to fill their soy complex demand needs.

A late week rally in soybeans bumped July soybeans right up against a trend line off of recent highs dating all the way back to the end of 2019. Traders will be closely watching the market next week for signs that this relentless downtrend in soybeans has changed. A weekly close above the 20-day moving average is a good start but follow through next week will be needed.

Wheat continues range trade.

July Chicago wheat was 5-1/2 cents higher this week to close at 522. July KC wheat was 3 cents lower this week to close at 480. July Minneapolis Spring wheat was 9-1/4 cents higher this week to close at 516. A wet two-week outlook for the plains is seen as favorable to wheat growing conditions. On the other hand, widespread frost risks this weekend are going to be harmful to the growing winter wheat crop. Wheat export sales remain on pace to meet the USDA estimate. Support should be found at the 517 area on Chicago wheat charts while resistance will come in near 538.

Spot Cheese Up Fifth Day In A Row

The dairy spot markets traded higher in every product this week. Cheese prices in the spot trade were up 9 cents this week on strong follow-through from last week’s 13.75 cent gain. Spot cheese prices are now 28% off of the recent lows. Butter was the other market to make an impressive move this week, gaining 10.25 cents to close the week. Whey prices continue to struggle against long term resistance of $0.40/lb, settling at $0.3975/lb on the week. While powder did trade higher this week, it is only 4 cents off of the lows of the year as other products are recovering faster.

The Class III 2020 average traded from $14.79 to $15.16 to finish out the week. Recent positive trade and technical developments are enough for us to change our short term trend to up. Recent reports of milk plants that were forcing producers to reduce production allowing producers to slowly add back production does look supportive. You can see confidence coming back into the futures market as the June contract was able to trade up to limit on Monday and Tuesday of this week. Class IV prices continue to lag on slow non-fat powder recovery.