Corn breaks recent range, moves higher.

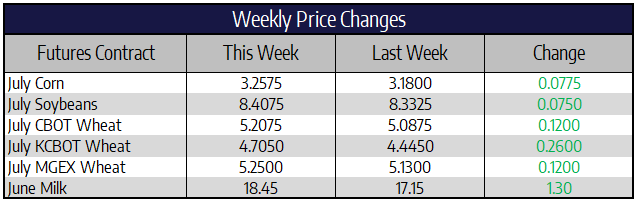

July corn futures were 7-3/4 cents higher this week to close at 325-3/4. December futures were 6 cents higher this week to close at 338-3/4. Corn prices were finally able to break out of their tight range this week, closing into a new 5-week high. Building heat and dryness in the Plains and western Corn Belt added strength to the grain complex this week. Two-week outlook forecasts are calling for much of this heat and dryness to hang around for a majority of the corn belt. After this week’s plentiful rains, heat and dryness may be just what the doctor ordered for this corn crop to get off to a great start. Dryness should also allow for post-emergence field work to scream along, making this projected record corn crop seem closer to a reality across the Midwest.

US ethanol production continues to rebound from the demand destruction that was seen in March and April. Production was up 9.2% this week topping 5.06 million barrels. Even with this increase production is still down 31% from last year. Managed money traders were over 240,000 corn futures contracts net short going into the week. Price action and a spike in open interest points to short covering as the reasoning behind this week’s pop in prices. Even with the slight move higher this week the corn market has little to no weather premium built in at all. An extended dry spell would cause more short covering by heavily short fund traders.

Soybeans higher this week.

July soybean futures were 7-1/2 cents higher this week to close at 840-3/4. November futures were 7-1/4 cents higher this week to finish at 851-3/4. Trade tensions continue to fester between the US and China over the political issues in Hong Kong. Through the continued spat, China has bought and continues to buy Brazilian soybeans. Reports are evolving that China is attempting to book Brazilian beans out into the fall of this year. US harvest is historically a time when US exports account for a majority of the global soybean market. President Trump is set to hold a press conference Friday afternoon on US relations with China. Sources feel China may reduce its imports of US agricultural products if Trump issues sanctions in response to China’s national security laws impeding Hong Kong’s democratic reform protesters.

A combination of a rally in the Brazilian currency as well as a break of trend line lower in the US dollar helped add support to bean prices this week. A continuation of this trend will make US beans more competitive on the global export market as we work towards fall. A severe drought in southern Brazil and northern Argentina has resulted in the lowest water level on the Parana River in more than 50 years and the lowest ever during the month of April. 80% of Argentina’s grain exports originate at the numerous ports on the Parana River near the city of Rosario. Grain vessels have been forced to leave a portion of their loads due to low water levels. Argentina is the largest exporter of soybean meal and third largest exporter of soybeans and corn.

Wheat moves higher on production concerns.

July Chicago wheat futures were 12 cents higher this week to close at 520-3/4. July KC wheat was 26 cents higher this week to close at 470-1/2. July Spring wheat was 12 cents higher this week to close at 525. Reduced production has been the main focus for the wheat market for some weeks now. The European Union lowered its wheat crop this week to just 121.5 million metric tons for 2020/21 compared to their latest projection of 125.8 mmt. This projection would be well below the 2019/20 crop of 130.8 million metric tons. Exports were also lowered this week to 25.6 mmt, 1.5 mmt below the previous forecast and 6.9 mmt below last year’s export number. The lowered production and export numbers are a direct result of the less than ideal growing conditions in Europe. A drought has been building in much of Europe’s Black Sea region for the last few months now. Hot dry conditions over the next two weeks could also be hurtful to US wheat in the Plains states. Frost damage early and heat/drought damage late will more than likely reduce yields.

Spot Cheese “Barrels” Through $2.00/lb.

Futures prices continue to be driven by the dramatic increase in spot cheese prices. The block/barrel average has risen above $2.00/lb, gaining 21.25 cents to finish the week at $2.1263. Price action seems to still be driven by the reopening of food service lines drawing cheese out of the spot markets. Butter prices also made new highs for the recent move gaining 7 cents on Friday to finish that week at $1.66/lb. Positive butter and cheese prices show that the current strength is in the fat complex. Nonfat powder was able to finish the week above the psychological threshold of $1.00/lb settling up slightly at $1.03/lb. Whey’s false breakout over the $0.40/lb level has quickly led to a reversal lower, as whey prices lost 5.75 cents this week and are now all the way back to $0.305/lb.

The Class III 2020 average traded from $15.78 to $16.23 to finish out the week. Last week futures price action ignored the continuation of cheese prices higher. But futures could not ignore the aggressive moves higher this week, as the June contract settled as an impressive $18.50. This compares to the June contract low of $10.68 on April 22. The Class III forward curve has become heavily inverted, as the market is pricing in a decline in prices further out into 2020.