Corn continues to grind lower.

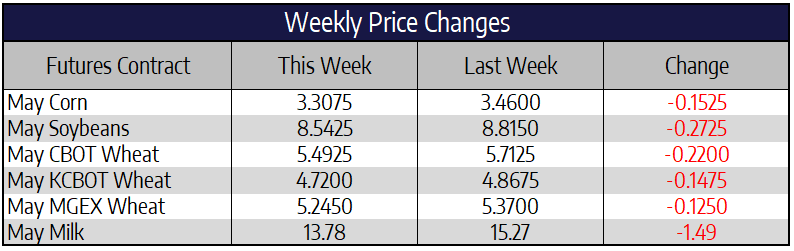

For the week, May corn was down 15-1/4 cents to finish at 330-3/4, a contract low. December corn traded 13-1/2 cents lower this week to close at 30-3/4. Export sales for the week ending March 26 totaled 42.3 million bushels old crop and 800,000 bushels new crop. In the USDA’s Prospective Plantings report released Tuesday, corn acres for the 2020 growing season were estimated at 97 million acres. This estimate is up 7.3 million acres from last year and just shy of 2012’s record 97.3 million corn acres. The USDA came to this estimate after compiling farmer surveys taken in early March. Soybeans have likely picked up some of the intended corn acres since USDA’s survey work was completed.

With a global pandemic at hand, US commodity markets have lacked interest in trading any sort of weather issues. South American weather has been overall non-threatening up to this point in the growing season. But, reports this week stated conditions are quickly becoming dry. Currently 64% of the countries corn growing area has seen less than 50% of its normal precipitation in the past 30 days. Most of the area of concern is in far southern Brazil. US and South American weather should play a key role in price discovery in the coming months.

Soybean futures take a hit this week.

May soybeans were down 27-1/4 cents this week to close at 854-1/4. November soybeans were 15-1/4 cents lower this week to close at 861-1/2. Even with all the negative news thrown at the market during the month of March, front month soybeans managed to post just a 6-3/4 cent loss. The losses in commodities across the board paled in comparison to the losses in the equity market during the first quarter of 2020. The Dow lost 23% of its value alone in March, its greatest lost since 1987. The S&P lost 20% of its value, while the Nasdaq shed 14% in the first quarter of the year.

Data out of Brazil for the month of March showed a massive month record for soybean exports. Brazil exported 11.6 million tons in March; this is 38% higher than March of 2019 and 30% higher than the previous record for March set in of 2017. US exports during February were a mere 2.76 million tons. This was the lowest soybean export volume since February of 2004. Part of the reason behind the smaller US exports has to do with seasonality. Brazilian beans are nearing the tail end of their harvest when export volumes are the highest, same is true here in the US during harvest. Another reason for the huge discrepancy between export volumes is the weakness in the Brazilian Real vs the US dollar. With a much weaker Real, Brazilian beans are more competitive on the world market.

Wheat backs off of recent highs.

May Chicago wheat was down 22 cents to end the week at 549-1/4. May Kansas City wheat was down 14-3/4 cents to close at 472. Minneapolis Spring wheat on the May contract was down 12-1/2 cents this week to finish at 524-1/2. Russia announced late in the day on Thursday that they would limit grain exports to 7 million metric tons between April thru June. The USDA had previously projected Russian grain exports at 35 mmt for the year; that figure is most likely too high with this week’s announcement. The market finished Friday right at the 100-day moving average. After price action to start the week Friday’s close could be seen as supportive. First support looks to be near the 535 mark while first resistance comes in around the 560 area.

Block Price Breakdown Continues

Cheese markets in the spot trade continue to collapse as fears surrounding too much milk during the spring flush and virus shut downs scare buyers from the markets. The block price dropped 12 cents on the day to finish at $1.15/lb. Barrels were down 3.75 cents to $1.1375/lb. The spread between blocks and barrels has now been almost completely erased. Butter and powder resumed their trade lower after yesterday’s pause. Butter was down 3 cents and powder was down 1.75 cents. Whey had zero loads traded in the spot market all week, but there were bids and offers in the market on Friday. Prices remained unchanged at $0.33/lb.

Class III was hit hard from the drop in barrel prices today. May trading limit down at one point during the day and still finishing down 70 cents at $12.18. The 2016 low was $12.20. There is potential for milk to catch support off of this low. In 2016 prices went from $12.20 to $17.97 in about 3 months. A bottom from this current down move could be V-shaped and recover quickly when demand returns. The Class III 2020 Average finished out the week slightly off the lows at $14.83.