Corn free fall continues.

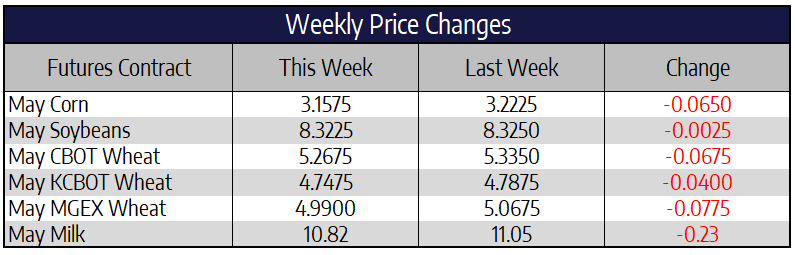

May corn struggled once again this week trading to an early week low of 301 but closing at 315-3/4 down 6-1/2 cents this week. Since its most recent high back in late January front month corn has lost nearly 80 cents. December corn lost 6-3/4 cents this week to close at 336-3/4. Spring field work was in full throttle across much of Iowa, Indiana and Illinois this week. Some locations reported more than 50% of intended corn acres were planted before rain hit late in the week. Reports out of the Eastern corn belt had a different tone given wet weather impeding progress. Given current weather patterns, this trend may not change until we get closer to May 1st. The 6-10-day outlook appears favorable for progress to continue in much of the western corn belt in the next week. However, above normal precipitation is forecasted for a majority of the eastern corn belt.

South American weather has been less than ideal as of late. Nearly 70% of Brazil’s second crop corn regions have seen less than normal precipitation over the last 30 days. However, CBOT prices seem to not be concerned with South American weather yet. With a dry two-week outlook in Brazil the trade may start pay attention to an issue that has been growing vastly in the last month. A Reuters report rumored on Thursday that China is looking to build its state grain reserves with cheap US grain. They are reportedly interested in 787 million bushels of corn and 367 million bushels of beans. The trade will be watching for these sales to come to fruition in the coming months as China attempts to fulfill their Phase one trade agreement.

Soybeans fail to rally higher.

After a rough start to the week May soybeans rallied back to end the week with just a ¼ cent loss closing at 832-1/4. November soybeans closed at 841-1/2 down 9-1/2 cents this week. China and Mexico combined to buy nearly 500,000 tons of soybean for the 2019-2021 marketing years this week. This sale equates to roughly 20 million bushels. These sales are a welcome sign China is striving to meet their phase one trade agreements. Despite the agreement a gluttony of freshly harvested higher quality Brazilian soybeans are making their way to China as we speak. This should curb large Chinese purchases of soybeans in the coming weeks.

The Brazilian Real continues to weaken vs the US dollar, this week the USD vs BRL traded to a new record of more than 5.70 Reals to US Dollars. Much of the weakness happened late in the week after news broke Brazil’s Justice Minister had resigned. The Real to Dollar differential has climbed 42% since the start of the year. Political instability and government turmoil continue to deepen within the country. Brazilian farmers have sold and forward contracted a record 35% of their 2020-2021 production given the steep currency differences between the Real and US Dollar. Profit margins for growing soybeans are 20-25% in central Brazil to as much as 50% in Southern Brazil where transportation costs are lower.

Wheat gives up early week gains.

After a string of strong days to start the week a tough Friday session resulted in Chicago wheat trading 6-3/4 cents lower this week to close at 526-3/4. May Kansas City wheat futures were 4 cents lower this week to close at 474-3/4. May Spring wheat futures were 7-3/4 cents lower this week to close at 499. Weather in the US as well as in the Black Sea region and Russia remain at the front of the mind for wheat traders. Precipitation fell this week in some of the Black Sea region this week but was not enough to recharge soils. Forecasted rain in the southern plains should be helpful in the next two weeks but frost damaged KC wheat remains a concern. Ukraine has capped old crop wheat exports at 20.2 million tons to ensure domestic market stability. Ukraine has already shipped 18.5 million tons this year suggesting they will run out of exportable supplies before the end of the marketing year. There is already speculation, given current crop conditions, that both Russia and Ukraine could extend their export restrictions into the 2020-21 marketing year.

Cheese Prices Bounce

Spot cheddar prices once again pushed higher today as the market tried to bounce off of some of the lowest prices we have seen since the 2003 and 2001 lows. Block prices were up 2.00 cents and barrels were up 1.00 cent on the day. The block/barrel average is now at $1.06/lb. Price action in the Class IV products continues to be weak as butter and non-fat powder both continue to slide lower. Whey was unchanged on the day at $0.385/lb vs. the high of the week at $0.39/lb.

This was the first up week for cheese since March 9th and bouncing off of such critical long term support levels does look like there is the potential to put in a bottom here. Class IV did not show the same signs of recovery as Class III towards the end of this week with the May contract finishing at $10.05. The Class III 2020 average made a new low this week of $14.44 and finished up off of it slightly at $14.60.