Corn heads lower as energy sector continues to struggle

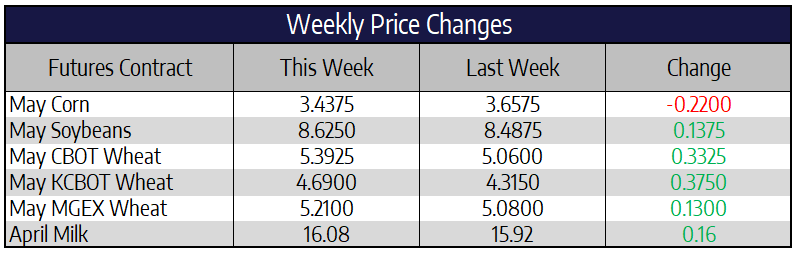

May corn was 22 cents lower this week to close at 343-3/4. December corn closed the week at 363-1/4 down 9-3/4 cents this week. Reports this week of ethanol plants idling or greatly slowing production hurt the corn market. Falling gasoline prices in the recent weeks has dropped the price of gasoline below the price of ethanol. Log jams in the ethanol pipeline have caused some plants to drop basis levels 30 cents this week. The oil trade war between Russia and Saudi Arabia is compounding the factor for the energy sector as a whole. A lack of overall ethanol demand given less driving admits COVID-19 is also a tough pill to swallow for the ethanol industry. Ethanol stocks have been rising this year as margins continue to struggle. DDG’s that have been used for animal feed as part of ethanol’s by-product will need to be replaced by some other sort of feedstuff. Weather that be another corn product or not at the end of the day the animal units will still need to be fed.

Much of the focus in the corn market will soon be flipping to acreage projections due out from the USDA at the end of the month. Initial USDA projections have come in near the 94-million-acre mark for corn, some private forecasters have estimated as high as 97 million acres. All of these projections, however, are just that, projections. Corn planters have yet to roll in the corn belt here as we approach April. Weather in the next six weeks will be the final say on how much corn gets planted when. US government forecasters came out this week and predicted widespread flooding this spring, particularly in parts of North and South Dakota as well as Minnesota. But the forecasters stated they do not see this years possible flooding as severe or prolonged as the historic Midwest floods of 2019.

Soybeans rally as soybean meal screams higher

May soybeans this week gained 13-3/4 cents closing at 862-1/2. November soybean futures rallied to erase early week losses but still closed down 3-3/4 cents at 860-3/4. Down in Argentina farmers are remotely striking and refusing to sell commodities. An export tax on soybeans was increased this week by Argentina’s government. The increased taxes are an attempt to generate more revenue for the country which is facing rather tough times with 10.5% unemployment and a debt to GDP near 90%. The tax increase could not come at a worse time for Argentina’s farmers who are facing dryness increasing daily taking down the potential size of their soybean crop. Adding fuel to the fire is an Argentina 14-day quarantine on European ships, this has the soy complex worried about other possible port closures. Also, with less ethanol plants running, competition from DDG’s has decreased giving soybean meal nearly a 30 dollar per ton boost this week. This was soybean meals best week since May of 2016.

Soybean sales of at least 120,000 tons destined for China were announced Thursday. Chinese importers reportedly bought beans out of the US Pacific Northwest looking for shipment before the end of April. Soybean ending stocks are not nearly as large as corn or wheat ending stocks. China buying soybeans as well soybean meal demand that has been on fire gives soybeans a look at some upside potential as we head towards spring planting decisions.

Wheat the big winner this week

May Chicago wheat was 33-1/4 cents higher this week to close at 539-1/4. May Kansas City wheat was 37-1/2 cents higher this week closing at 469. May Minneapolis spring wheat was 13 cents higher to close at 521 this week. The big story in wheat this week was Chinas purchase of at least two US cargos of hard red winter wheat. The last US wheat sale to China was back in October of 2019, the most recent sale before October came in December of 2016. Also helping wheat this week was the continuation in the expansion of locust swarms across eastern Africa and the middle east. The swarms represent “an unprecedented threat to food security,” according to the Food and Agriculture Organization at the United Nations. Among the countries expected to be the hardest hit are Kenya, Ethiopia, Somalia, Iran, Pakistan and Sudan. Food security may become a concern for some countries as both locust and a worldwide pandemic hurt their food supply.

Empty shelves at grocery stores around the country here in the US are also a welcome sign for domestic wheat demand. Staples of flour, bread, and pasta have been tough to find in certain parts of the country as those told to isolate secured essential foods in the last few weeks. Increasing domestic and world demand was encouraging news this week and gave Chicago wheat it’s best weak since June of 2019.

Dairy Markets See Recovery Follow Through

Yesterday, the dairy market pushed higher in a big way as Class IV contracts had limit up moves. Butter in the spot market was up 5.5 cents. Butter futures were trading on expanded limits today (normally 5 cents) and the April contract settled the day up 8.925 cents. It looks like a short term bottom at the very least is in for the butter market. Cheese prices in the spot trade were mixed today with barrels climbing 4.25 cents and blocks losing 2.5 cents. This does help alleviate the record high block/barrel spread. Non-fat powder had a decent up day today gaining 2.5 cents on 16 loads traded. High volume on an up day after the recent downtrend looks positive. Whey prices were unchanged.

Futures traded higher today with the Class III 2020 average finishing up 11 cents at $16.15. This week, the average virtually retested the all-time low for the average and bounced off of it. This shows that this level should help serve as support. Class IV prices responded positively to the higher butter and powder prices but remain well discounted to Class III with a 2 dollar spread between the April contracts.