Much of the same, corn continues sideways to lower

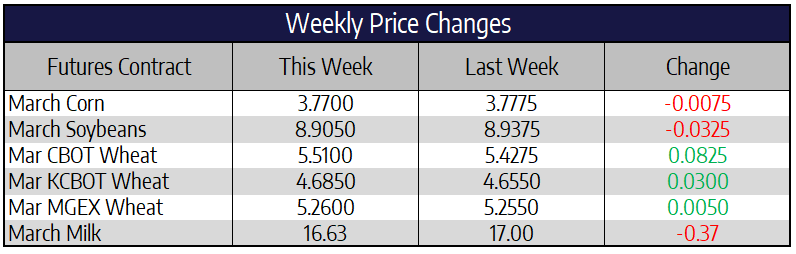

March corn was 3/4 of a cent lower on the week to settle at 377. December corn closed the week at 385-1/4 down 3-1/4 cents. The USDA held their annual Agricultural Outlook Forum Thursday and Friday this week. Preliminary corn acreage numbers were estimated at 94 million acres planted, up from 89.7 last year. The USDA pegged corn yield at a record high 178.5 bushels per acre, this leaves production at 15.46 billion bushels. With a slight increase to domestic use, mostly in the feed demand category, and export ticking up slightly the forum estimated carryout to come in around 2.6 billion bushels. This would be up substantially from last year’s 1.8-billion-bushel carryout. This would be the highest ending stocks since 1987. All of these outlook numbers are of course dependent on the ability to plant the corn come springtime. Much of the Corn Belt is more saturated as compared to the same time a year ago.

A lack of fresh buying from China with the Phase One trade deal has been a pressure on corn prices in the last month. No apparent weather issues of note in South America along with a continually strengthening US dollar are seen as short-term headwinds for the corn market. Managed money traders have continued to hold their net short position since mid-August which has kept prices trending mostly sideways to lower since that time. Corn has not had a weekly change, up or down, of more than 7 cents since the first week of November. The doomsday worst-case scenario laid out by the USDA outlook this week is scary to imagine what “could be” if projections ring true in 2020.

Soybeans lower this week

March soybeans were 3-1/4 cents lower this week to close at 890-1/2. November soybeans closed at 916-1/4 down 1-1/2 cents this week. After two consecutive weeks of closing higher, the soybean market closed lower to end the week. Markets are still unsure about the total impact of the coronavirus to the overall global economy. The USDA’s outlook numbers released today for the soybean market have somewhat of a bullish lean. The USDA sees production at 4.195 billion bushels up from last year. But with a projected record crush and exports increasing to 2.05 billion, ending stocks are pegged lower than this year. Ending stocks projected at 320 million bushels would be down from this year’s 425 million bushels and much lower than the 920 million bushels seen last year. Secretary of Agriculture, Sonny Perdue, stated at the USDA Outlook Conference that he anticipated that China will “start ramping up “purchases under the Phase One deal this spring. Soybean markets seem to have put in a short-term low, and any sort of Chinese buying will be poised as momentum for this market to continue working higher.

Reports out of South America are that Argentina’s crop could be projected higher if recent rains continue. The welcome rain in Argentina is, however, hindering harvest progress in Brazil. Harvest was seen as 27% complete this week, this compares with 36% a year ago and 25% on average.

Chicago wheat moves higher

March Chicago wheat was 8-1/4 cents higher this week to close at 551. March KC wheat was 3 cents higher to close at 468-1/2. March MPLS spring wheat was 1/4 cent higher to close at 526. Wheat markets moved higher this week on strength during Tuesday’s trading session. Chicago and KC wheat were 20+ cents higher on Tuesday following news over the weekend that the locust plague in Africa was getting worse and could potentially reach into China in the coming weeks. Markets cooled off to finish the week but held onto modest gains overall. The US dollar continues to maintain its upside momentum which will be a headwind for export moving forward. The outlook for tightening US ending stocks in 2020 should provide some underlying support. Winter wheat planting is down sharply but the USDA sees higher spring wheat plantings and only a slight decline in total wheat planted area.

Weaker Spot Markets Keep Milk Prices Pressured

A lack of any strong bidding interest in spot dairy markets kept selling interest high in dairy futures markets. A sharply lower US dollar failed to provide any support as that dollar weakness was accompanied by renewed coronavirus fears. The stock market was off by 1%, and feed, livestock, and energy markets were lower as well. That outside market pressure appeared to fuel some spillover selling pressure in dairy futures. Needless to say, it was a rough week. Class III milk prices were down 3 of 4 days this week and overall have been down 7 of the last 9 days. The Mar Class III contract lost 39 cents this week. Class IV milk prices didn’t fare much better, also being down 3 of 4 days and Mar Class IV fell 29 cents this week. The selloff this week pushed nearly every 2020 Class IV contract into new contract lows, wiping out all of the rally from the 2019 low. While it’s been a rough stretch for milk prices, there were a couple of good developments this week that could point towards a coming turnaround. First, the Global Dairy Trade auction saw cheese bid up about 10 cents to $2.05. That puts the CME block/barrel average at just over a 35 cent discount, and in the past, that wide of a discount has resulted in a not too far off into the future turnaround in cheese prices. Also, the January Milk Production report released yesterday was supportive as Jan milk production was up only 0.9% year-over-year. While cow numbers were up, a good chunk of the recent increase in cow numbers have come from upward revisions to many 2019 months. The good news about that is that the higher cow numbers during those months didn’t stop November Class III milk from rallying to $20.45.