Corn trades lower, exports still lag

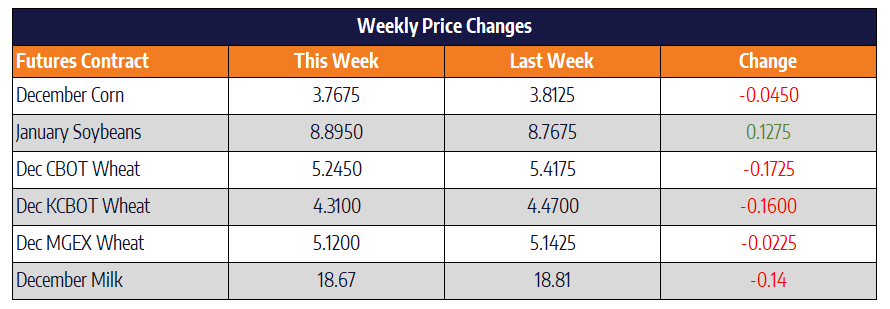

Corn futures failed to move higher this week after last week’s slight gains. March corn finished down 4-1/2 cents closing at 376-3/4. July corn was down 3-1/2 cents to close at 386-3/4. Ethanol production has been steadily increasing since a low in mid-September. Production is still 3.7% lower than last year’s number but overall corn used in production is slightly ahead of the 5-year bushel average. Total corn use for ethanol is projected slightly below 5.4 billion bushels for 2019.

Corn exports continue to lag last year’s pace by a substantial margin. Export sales released Thursday morning for the week ending November 28 were rather disappointing coming in at 546,115 tonnes. Sales need to average 815,000 tonnes per week to reach the USDA forecast. Brazilian competition has been a headwind for US corn exports all marketing year, but Brazil’s November exports dropped sharply from last month’s record. This is a promising sign that the mammoth 2019 Brazilian crop may be nearing the end as far as exports go. With Brazilian second crop corn harvest planned for mid-2020, the next couple months may be the perfect window for US corn to fill the world export gap.

Soybean market posts double-digit gains

March Soybeans posted gains in its last four trading sessions and finished the week up 12-1/2 cents to close at 903-3/4. July soybeans gained 13-1/4 cents this week settling at 931-1/2. Managed Money funds sold a record 61,393 Soybean futures and options contracts in the week November 19 – 26. This broke the previous record of just over 60,000 contracts back in mid-December of 2017. Soybean futures lost 40 cents in the month of November after any sort of finalized trade deal between the US and China failed to materialize. Massive soybean purchases are what the US is suspected to be pushing as part of a deal. But China has made it clear they will only buy according to their market needs. With President Trump’s comments this week that he may be willing to wait until after the 2020 presidential election to get a deal in place, China may be content to pay the tariff to meet their needs in the short term. With Brazilian and Argentinian beans ready to market come late-February, lack of a trade deal could mean depressed bean prices well into 2020.

On the bullish side of the coin, US dollar futures had a rough week trading lower in five of its last six trading sessions. This helps make our beans more competitive on the world export market. Also, Argentine soy crushing giant Vicentin is struggling to repay over $350 million in debt and some plants will likely halt production while it seeks relief amid an economic slowdown in the country, a source close to the company said. This could help open the door to the US for those needing soybean meal around the globe.

Wheat cools off after good finish to November

Chicago wheat futures posted modest gains on Friday but overall were down 17-1/4 cents on the week to close at 524-1/2 on the March contract. March Kansas City wheat closed at 431 down 16 cents on the week. Minneapolis Spring wheat lost 2-1/2 cents this week closing at 512 on the March contract. Monthly wheat exports from the US for October reached 2.143 million tonnes, up 11% from last year. For the USDA Supply/Demand update next week, traders see US wheat ending stocks near 1.01 billion bushels as compared with the November estimate of 1.014 billion bushels. Front-month wheat had a rough week losing nearly all its gains late last week, but prices are still holding above a previous major resistance level near the 525 mark.

Spot Cheese Drops Again, But Futures Recover

After yesterday’s aggressive decline in cheese futures prices, it looked like another drop in spot cheese could push the market considerably lower. But it appears the market was fearing the worst yesterday as a slight drop in the block and barrel cheese prices today didn’t push futures prices lower. The December Class III contract actually finished 18 cents higher on the day and January was up 7. The block/barrel average was down 0.875 cents after today’s trade settling the week at $2.09875/lb. The most exciting spot market of the day was the non-fat powder trade pushing up 2 cents on the day to break into new 2019 highs. After the GDT traded $1.39/lb powder earlier this week, our prices may be following global prices higher. Non-fat powder finished the week at $1.2675/lb. Whey and butter trade was non-existent today as no loads traded hands and prices remained unchanged.

It was impressive to see that the Class III December contract pushing so much higher today. There has been a trend recently of the front-month contract continuing to push higher into expiration. We saw that this week as the November contract settled at the highest price of the contract at $20.45. If this trend continues, then December may be able to continue to move higher even if 2020 contracts begin to trade lower. Class IV contracts found some footing today on the higher non-fat powder number, but the recent decline in butter prices is holding Class IV prices back.