Corn has a quiet week

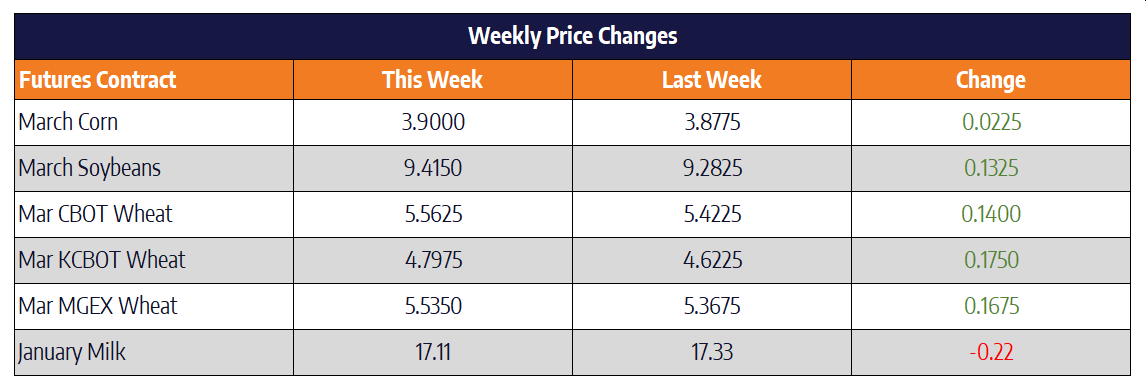

Corn prices had a very quiet Christmas shortened trading week staying within a five-cent trading range all week. March corn was up 2-1/4 cents on the week settling at 390. Export sales for the week ending December 19th came in on the smaller side of expectations at just over 24 million bushels. However, looking at the big picture, prospects for export upside look promising. The US dollar has continued to trend lower since late September and some major indicators are pointing towards further downside. Also, the Brazilian Real reached a new 7-week high making our exports more competitive versus Brazil. The currency factor paired with potential Chinese purchases of corn and corn products as a part of the Phase One deal are all seen as underlying support to the market.

One of Brazil’s major corn growing regions, Rio Grande do Sol, has been warm and dry here recently. It has been reported that some areas in the region have not had rain for nearly 50 days. This paired with 100+ degree temperatures is stressing the corn crop. Some traders are calling for an adjustment lower in South American production in the January WASDE due out 11 AM on January 10th.

Soybean market continues moving higher

March Soybeans spent a majority of the four-day trading week working higher but late in the trading session Friday most of the week’s gains were erased. March futures were up 3-1/4 cents on the week closing at 941-1/2, nine cents off of their high. March soybeans still held on to a slight gain for the week. This makes four consecutive weeks of gains in the soybean market. May feel much of the initial trade deal “bump” has now been priced into the market. Further follow through weather that be details of the deal or actual purchases of soy products may be needed to propel this market up through previous highs.

Soybean oil futures gaped higher this week as the rally in palm oil continues. Palm oil futures reached a three-year high as output continues to drop in Malaysia. Soybean oil is seen to fill the production void in palm oil. The soybean market still waits in anticipation for details of the phase on trade deal between the US and China. The trade pact is set to be signed some time in January. Traders will also be closely watching South American weather which has been hot and dry in some regions as of late.

Wheat moves higher

Chicago March wheat futures traded 14 cents higher this week to close at 556-1/4. March Kansas City wheat moved higher for a third week in a row improving 17-1/2 cents to settle at 479-3/4. March Spring wheat futures also joined the party rallying 17-1/2 cents also to close at 554-1/2. The US dollar was again lower this week and looks to be on the move lower into 2020. Wheat exports were rather soft this week, but overall exports have met 70% of the USDA estimate which runs until June for the wheat marketing year. Prospects for US wheat to travel to China continue to add strength to the market. Wet weather looks to be in the forecast for a majority of the plains, but overall drought continues to creep in to the heartland from the four corners region of the US.

Cheddar Blocks Up Barrels Down

Cheddar blocks and barrels are moving the opposite direction today with the price of blocks jumping 3 cents but the price of barrels dropping 3 cents. While this does leave the block/barrel average unchanged on the day it does bring into question who will be the follower and who will be the leader. The spread between blocks and barrels has been volatile lately and that is likely to continue. While whey prices traded slightly higher today they are leaving the week unchanged in price. Butter prices were able to finish the week above $2.00/lb and that does look supportive that a short term bottom could be in if world prices don’t continue to drag U.S. prices lower. Non-fat powder was slightly lower but mostly uneventful this week.

Class III futures were mostly trading higher today as the Class III 2020 average gained $0.02 to finish the week at $17.35. Overall, it was a fairly quiet holiday week with one less trading day. Class III and Class IV prices have finally narrowed the gap with the spread between the two at the shortest levels of the year when comparing the 2nd month contract of January for Class III and Class IV.