WASDE report drops yield, along with demand

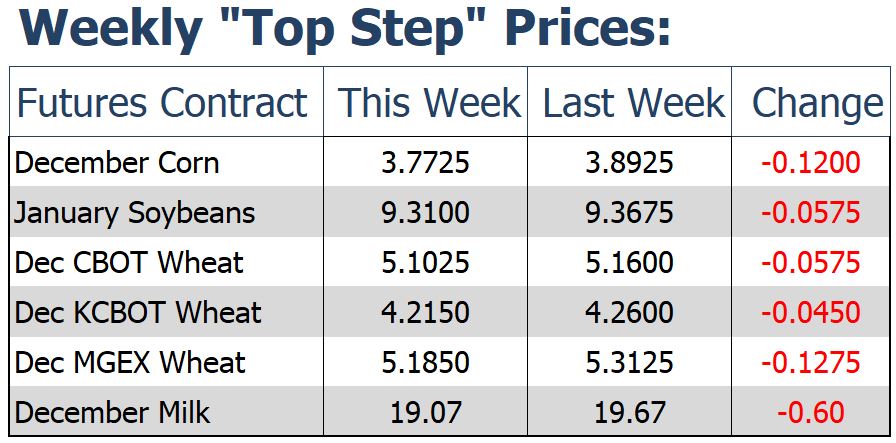

The corn market traded higher on Friday but was unable to erase its losses from earlier in the week. December corn finished down 12 cents on the week, closing at 377-1/4. July corn was down 10-1/4 cents to finish at 399-3/4. Friday’s November USDA WASDE report cut U.S. corn yield by 1.4 bu/acre; that puts the 2019 crop 9.4 bu/acre under last year’s near record crop of 176.4. The cut to total supply was essentially offset by a similar cut to demand. All in all, ending stocks were reduced by 19 million bushels, this was enough of a headline to rally the corn market two cents.

Corn exports remain a thorn in the side of this market. Export sales for 2019/20 as of October 24 are running just 5% better than the same point in 2012. Abundant and cheaper corn out of South America has made it tough for U.S. corn to compete in the world market. From July – October, Brazil has shipped 44% more corn than their previous record which was set two years back. Pair that with record exports out of Argentina and Ukraine and one can clearly see why the more expensive U.S. corn has seen little to no love from corn buying countries.

Yield unchanged, stocks larger in WASDE

For the week, November soybeans were down 4-3/4 cents, settling at 919-1/2. July soybeans ended at 966 down 4-3/4 cents. Today’s WASDE report was slightly negative for the soybean market. Yield and harvested acres were left unchanged, while overall use was cut by 15 million bushels bringing U.S. stocks to use ratio up 0.4%.

On Thursday, China’s Commerce Ministry said that U.S. and Chinese negotiators have agreed in principle to roll back tariffs in simultaneous stages if their trade talks continue to advance. We have yet to hear of an exact timetable for when a “phase-one” agreement could be reached. But it has been said the two countries have held “earnest and constructive” talks. Speculators have continued to increase their net long position in recent weeks, implying faith in a trade war resolution in the near future. The funds have not held this sizable of a large net long position since June 2018, before the trade war began.

U.S. stocks lower, world stocks higher

December Chicago wheat closed at 510-1/4, down 5-3/4 cents. December Kansas City wheat was down 4-1/2 cents to finish at 421-1/2. U.S. wheat ending stocks were reduced on today’s WASDE report. but world wheat ending stocks were increased with the report. The world ending stocks number north of 288 million metric tons exceeded what analysts were expecting and sent the market lower. With corn exports so dismal, wheat exports have caught some traction in recent months. Wheat exports for the 2019/20 marketing year are running ahead of the USDA pace by a sizable margin. The U.S. Dollar that looked to be reversing and working lower for the last few weeks has shown recent strength. If it continues to rally, this could spell issues for wheat exports moving forward.

Milk Futures Slightly Higher After Better Than Expected Spot Trade

Yesterday’s 6-7/8 cent decline in the block/barrel average, following 13 consecutive up days, had the Class III market bracing for another significant down day in spot cheese today. Class III futures were weaker overnight and at this morning’s lows Nov was down 15 cents, Dec down 30, Jan down 15, and Feb was down 9. The Dec contract was down nearly 100 cents from yesterday’s high to this morning’s low. In the spot session, blocks fell 5-1/2 cents on one trade, but barrels closed unchanged with zero trades and two unfilled bids. Those positive developments in the barrels look to be the catalyst that got the recovery started in milk, and by day’s end all contracts Nov ’19 through August ’20 were able to close the day with single digit gains. Sep ’20 through Dec ’20 contract months all closed unchanged with zero trades. For the week the block/barrel average closed down 6-3/4 cents, it’s first down week since the week of October 14th. Here’s how other spot markets did on the week: butter -4-1/4, nonfat +2-1/4, whey -3/4.