Corn has a quiet week

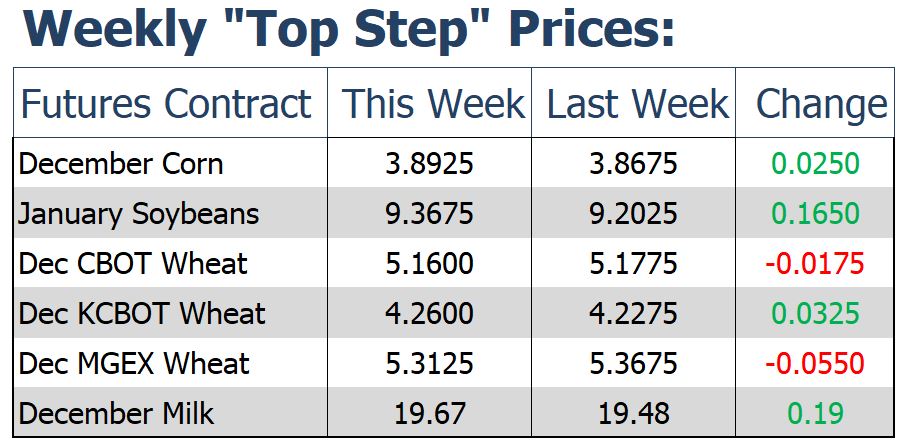

December corn closed at 389-1/4, up 2-1/2 cents on the week. July corn was up ¼ cent to finish at 410. The corn market had another rather quiet trading week, staying within a 10-cent range for a second straight week. Exports last week were yet again unimpressive. As of October 24, cumulative corn sales stand at 23.6% of the USDA forecast for the current marketing year. Sales of 824,000 tonnes are needed each week to reach the USDA forecast. Even with lackluster export numbers, implied domestic demand along with cash corn prices continue to remain strong. According to Farm Futures basis tracker, corn basis across the U.S. is seen 10 cents stronger than average even as harvest progresses along.

Corn harvest remains historically behind pace as October comes to an end. At 41% completed as of last week this pace is 21 points below the 5-year average. This slow pace is the third slowest corn harvest in the last 20 years and is only quicker than the harvest of 08 and 09. Some hope for those plagued with saturated soils may be in the cards in the coming weeks. The NOAA two-week outlook points to below normal temperatures paired with below normal precipitation centered around Iowa and covering a vast majority of the corn belt.

Soybeans find strength late in the week

November soybeans were up 4 cents on the week to close at 924-1/4. July soybeans closed at 970-3/4, up 3-3/4 cents. After poking into new highs mid-month just above the 945 mark, soybeans finished positive for the month of October. October’s monthly close marks the second consecutive month the bean market has settled above the 9-dollar mark on a continuous soybean chart. The last consecutive months to do so came back in early spring last year.

Late in the day on Friday, a headline flashed reading “China says it’s reached a consensus on core points with the US during this week’s trade talks.” The Chinese Ministry of Commerce said both sides had a “serious and constructive” discussion on “core” trade points in the last week. The bean market reacted to this positive headline and posted a rather strong session Friday pushing up against the 20-day moving average. With the on-going trade talks as a backdrop China bought U.S. beans on Friday, 132,000 tonnes for 2019/20.

Chicago wheat finishes lower

December Chicago wheat rallied late in the day on Friday but still closed down 1-3/4 cents on the week at 516. KC wheat was up 3-1/4 cents on the week, closing at 426, while December spring wheat closed at 531-1/4 down 5-1/2 cents for the week. Chicago wheat traded down mid-week and tested the 100- and 200-day moving averages near 502 and held. Support this week may have been found in a reduction in the Argentine crop by the Buenos Aires Grain Exchange. They are estimating the Argentine wheat crop at 18.8 million tonnes vs the latest USDA estimate of 20.5 million tonnes.

Spot Cheese Moves Higher For 10th Consecutive Day

The story of the week continues to revolve around the spot cheese market. Prices in the spot market have risen 5.375 cents on the block/barrel average this week. Today, barrels jumped another 3.75 cents but didn’t see a single load trade hands through the week. Sellers seem unwilling to come to the table to move inventory at the moment. Block prices did drop 2 cents today. Non-fat powder prices also made new highs for 2019 today pushing up to $1.1875/lb. Whey prices pushed a penny higher today but are unchanged on the week. Butter prices dropped 0.25 cents after today’s price action.

The futures market saw favorable price movement today but were unable to reach the highs of the week today. November has maintained a price point above $20 at the end of the week, settling at $20.19. The January class III contract made the strongest move on the day settling at $18.11 gaining 24 cents on the day. Class IV prices remain at a large discount to Class III futures with the relatively lower butter prices in the spot markets, despite higher powder prices.