Corn market cools off

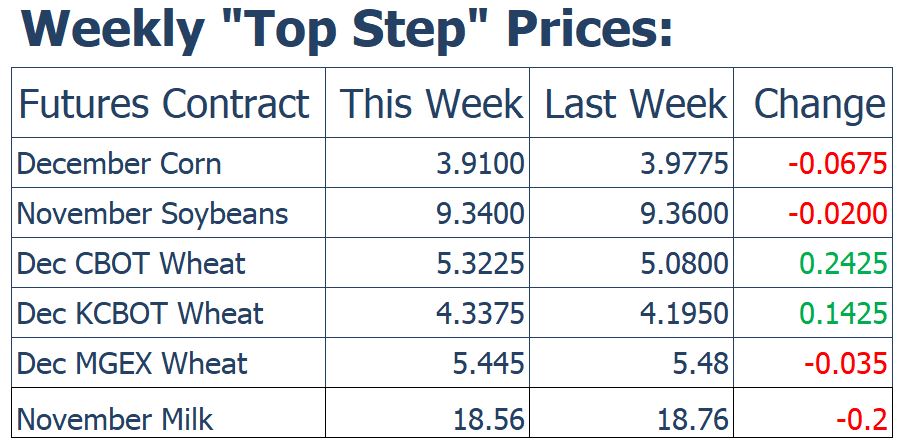

After five consecutive weeks of positive momentum, the corn market caught its breath this week, closing down more than six cents. December corn finished the week down 6-3/4 cents to close at 391 while July corn lost 1-1/4 cents this week, finishing at 415-1/4. Price action this week points towards the December chart consolidating here just below the four-dollar mark. Lack of new bullish news paired with harvest pressure may limit upside movement in the short term.

The USDA announced this week that it plans to re-survey farmers on intended corn and soybean harvested acres in Minnesota and North Dakota following recent snowfall in both states. Analyst’s estimates range from 150 million bushels to 400 million bushels of lost production from the snow event last week. Relief looks to be coming in the near future for the mostly waterlogged northern and western Midwest. The 8-14 Day Outlook from NOAA shows a high probability of below normal temps as well as below normal precipitation for a vast majority of the corn belt.

Soybeans post modest losses

Following corn’s lead soybean prices also backed off this week. November soybeans lost 2 cents for the week to close at 934 while July closed at 976 down ¾ of a cent for the week. Soybean harvest progress was seen at 26% complete as of Sunday, that is ½ the pace of the 5-year average of 52% complete. In the last 30 days some portions of Northern Plains have received northwards of 500% their average precipitation. Farmers in the Dakotas as well as other heavily saturated areas may need to wait for a hard freeze before even attempting to begin an already behind pace harvest.

Progress on the Chinese’s trade front has been promising in the last week. White House trade adviser Peter Navarro on Friday pointed to next month’s Asia-Pacific Economic Cooperation forum in Chile as the Trump administration seeks to formalize ‘phase one” of a possible trade pact with China. Navarro stated “We’re on the glide path to Chile and the meeting of two presidents mid-November. And the plan there is to have an agreement, so we’ll see what happens.”

Chicago wheat post huge week after US dollar breaks support

After a slow start to the week, Chicago wheat prices rallied to end out the second full week of October. December Chicago wheat had a rather impressive week closing up 24-1/4 cents at 532-1/4. December KC wheat followed suit closing at 433-3/4 up 14-1/2 cents, while December Minneapolis Spring wheat was down this week 3-1/2 cents to close at 544-1/2. After a third consecutive week of weakness the US dollar is down over 1.5% for the month of October. This recent weakness breaks a long-term support line dating back to early 2018 and could be a major driver behind the current strength across the wheat complex. Wheat exports which are running behind pace need all the help they can get from a weaker US dollar.

Cheese Falls Fifth Day In A Row, Futures Remain Neutral

Cheese prices have fallen in the spot market five days in a row. The most interesting development today is that the block/barrel spread now has barrels to a premium to blocks for the first time since May. Blocks are at $1.9675/lb and barrels are at $2.00. On the week, the block/barrel average is down 7.75 cents. Whey prices have dropped to the lowest price of 2019 today at $0.2850/lb. Whey also had the highest volume traded on the week at 62 loads. Butter prices lost 3 cents today but was able to remain positive on the week. Powder prices were unchanged at the highest price of 2019 for the third week in a row.

Futures prices have been expecting a decline in the cheese market for the past week, and because of that, we have not seen milk futures move much despite a 7.75 cent decline in the block/barrel average. Futures remain slightly discounted to current prices. Looking at the market structure between Class III and Class IV, it does appear that the market is more optimistic about the 3rd and 4rth quarter of 2020 for Class IV prices with the quarterly averages about 50 cents higher vs. Class III.