Corn rally continues, ending stocks lower despite yield increase

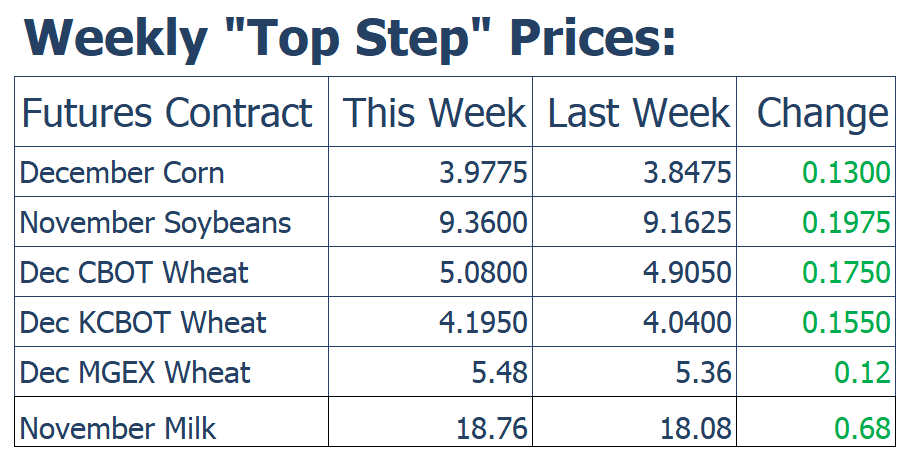

Thursday’s USDA World Agricultural Supply and Demand Estimate (WASDE) sent an initial shock to the corn market sending all the nearby contacts double digits lower. Friday’s trading session reversed the knee jerk report move to close December corn 17-1/2 cents higher at 397-3/4. July corn was also higher to end the week closing at 416-1/2. Digging into the WASDE numbers, the bearish first impression changes its tone. Even with the slight increase in yield, drops in beginning stocks for corn lowers the stocks-to-use ratio close to two percentage points. Although the corn supply looks to be in no immediate threat currently any drop in yield moving forward will be supportive for the market.

December corn has rallied more than 26 cents here in the last two weeks. Production concerns remain at the helm for the corn market as a hard freeze looks to end the growing season for most of the corn belt this weekend. Not only cold weather but blizzard like conditions will ravage the northern plains and some of the western corn belt this weekend with 40-50 mph winds forecasted in some areas.

Soybeans finish higher on yield cut

November soybeans continued their climb higher this week moving up 19-3/4 cents to close at 936. July soybeans followed suit finishing up 18-1/2 cents on the week to close at 968-1/2, its highest close since February. Thursday’s USDA crop report showed a yield drop of one bushel to final bean yield. To put this into perspective the USDA has only lowered October bean yield a bushel or greater 3 times in last 25 years. The yield cut was enough to pull soybean ending stock below the 500 million bushels mark. Ending stock are now back near pre-trade war levels which we have not seen since early last summer. Along with lowered production, soybeans found support on early Friday on rumors of a partial trade deal China in the near future. A tweet from President Trump Friday morning read “Good things are happening at China Trade Talk Meeting.”

Wheat shakes off bearish report given weather concerns and a weaker dollar

The wheat complex found strength across the board during Fridays trading session. Chicago December wheat closed 17-1/2 cents higher for the week to finish at 508. KC December finished up 15-1/2 cents for the week closing at 419-1/2. Minneapolis spring wheat pushed higher finishing up 12 cents for the week to close at 548. Weakness in the US dollar gave wheat the boost it needed to propel into new recent highs. A weaker US dollar helps American wheat compete better in the world export market. Wheat export sales are already are running 16% ahead of a year ago. The dollar closed below the 50-day moving average for the first time since August on Friday.

This week’s winter storm across the Northern Plains looks to be the nail in the coffin for this year’s historically behind pace spring wheat harvest. Harvest progress has been stagnant around the 90% mark for the last month. With delayed harvest across the country this fall, winter wheat acres come 2020 may be more difficult to find than ever before. In 2019 the US planted its fewest number of wheat acres on record since 1919, 2020 looks to be setting up to challenge that record low.

Barrel Prices Continue 11 Day Winning Streak, Up 42.25 Cents On the Move

The impressive move in the spot cheese market continued today as the barrel market pushed 7.25 cents higher on the day while blocks moved 2 cents lower. Net change to the block/barrel average was 3.75 cents with barrels at the highest price of 2019 at $2.0225/lb. Butter trade saw a surge of activity today as 28 of the 32 loads traded this week all took place on Friday. The price action pushed prices up 3.75 cents to put in a potential low for butter. Powder prices closed at a new high for 2019 for the third week in a row. Whey prices struggled this week but are finding support at $0.30/lb.

The most puzzling part about price action in futures is the fact that the spot cheese market is only 2 cents away from the highest cheese price of the year, yet futures are over a dollar away from the previous highs. After the voracious trade move that caused a limit up move followed by a limit down move 2 days later a few weeks ago, traders may be cautious to buy the spot cheese rally. This does leave a lot of room for futures to rally if cheese prices maintain current levels.