Corn lower this week.

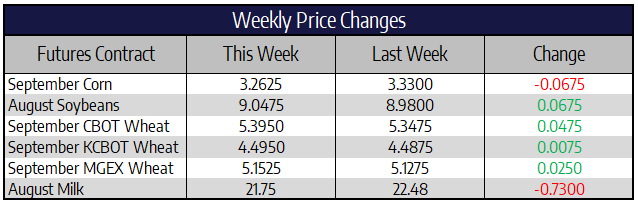

September corn futures were 6-3/4 cents lower this week to close at 326-1/4. December futures were 4-3/4 cents lower this week to close at 335. Early July heat stress looks to shoulder much of the blame for lowered US yield estimates by private analysts. Most have decreased their national corn yield estimate by 2 bushels per acre, coming in near the 176.5 mark. This would bring the US crop to a total of 14.87 billion bushels, 130 million under the current USDA estimate. While not a major change, the lower figures may be losing attention, given USDA’s projection for increased corn for ethanol use, which looks to be a prayer given COVID issues to gasoline demand since March. If USDA demand projections ring true and this revised lower yield becomes a reality, ending stocks would still rise 270-million-bushel year over year.

China held yet another corn auction from their state-held reserves this week. The 4-million-ton sale brought a record high price for the year topping 2,000 yuan per ton. That equates to nearly $7.30 US Dollars per bushel. It would make sense for China to continue to buy US corn if their domestic price is at that much of an extreme to corn prices here in the US. The US beef industry has the potential to see elevated exports in the near future. South America continues to struggle with the COVID-19 pandemic; as of late, the virus has affected livestock processors in Brazil and Argentina. Argentina has been closing packing plants where workers have tested positive for the virus. This could easily increase demand for US beef, especially into China.

Soybeans rally on continued China buying.

August soybean futures were 6-3/4 cents higher this week to close at 904-3/4. November soybeans were 4-1/4 cents higher this week to close at 899-1/4. Uncertainties about August weather and active buying from China is helping the soybean market hold on to some weather premium for now. Front month soybeans traded down to but rallied off of the 100-week moving average this week. The continued hold of a trend line off of the lows from May points to active buyers in the soybean market. A weekly close above nine dollars will be the next upside hurdle for this November bean market.

Friday morning brought yet again a USDA export sale announcement. Today’s sale of soybeans to unknown, most likely China, and sale of soybean meal to the Philippines marks the ninth consecutive day of a USDA daily sale announcement. As tensions continue to rise between the US and China the continued fear of cancellation of these sales down the line also rises. Chances are China is not making these purchases of US grains to live up to the phase 1 trade agreement but rather making purchases given the need for feed and food grains in China. US soybeans are currently at a 60-cent discount to Brazilian beans after a flood of Brazilian beans arrived in China in the last three months. This steep discount bodes well for US soybean exports in the coming months, while Brazilian exportable supplies remain small.

Wheat higher this week.

September Chicago wheat futures were 4-3/4 cents higher this week to close at 539-1/2. September KC wheat futures were ¾ of a cent higher to close at 449-1/2 this week. September MPLS spring wheat futures were 2-1/2 cents higher this week to close at 515-1/4. Wheat futures found strength during Friday’s trade. The buying power was just enough to push wheat futures higher on the week. Continued weakness in the US dollar helped support wheat futures this week. The International Grains Council cut their forecast for global wheat production by 6 million tons to 762 million. EU production was revised lower as well as Russian production.

Block/Barrel Spread Below 10 Cents.

Cheese prices in the spot trade have narrowed the gap between block and barrel prices for the third week in a row. In only a couple of weeks, the spread has gone from blocks being over 60 cents higher than barrels to only 9 cents. We have been expecting this correction for quite awhile now with how big of an extreme it was. The biggest question now is that, with the spread corrected, will cheese prices continue to drop or find support? Butter prices rose 4 cents as buyers seem to find value in the $1.69/lb area. Powder Prices closed below the psychological level of $1.00/lb and looks like it could struggle to break back above that level now.

The July to December average for 2020 traded higher initially in the week but pulled back to be virtually unchanged at $19.85 vs. $19.83 last week. A continuation of lower block prices seems likely as the market went so high so quickly. It may be healthy for the market to see the spread between blocks and barrels stabilize. The typical spread is close to about 5 cents blocks over barrels and we are close to achieving that goal. The market is still pricing in substantial declines in the market and may get too far ahead of itself to the downside if spot prices move lower rapidly.