Corn pushes to 4-month low

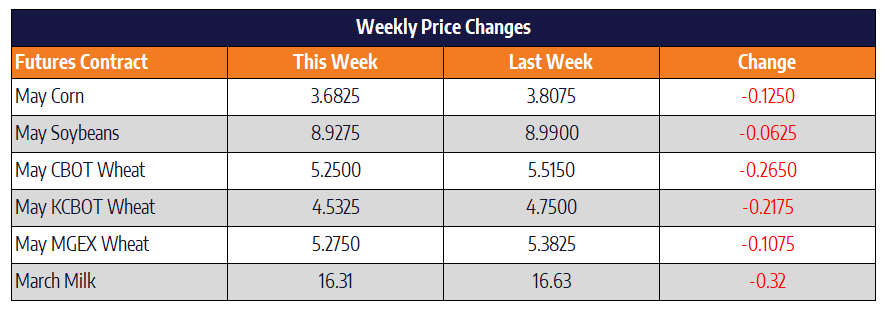

For the week, May corn was 12-1/2 cents lower to close at 368-1/4. December corn settled at 377, down 9 cents on the week. December corn futures, as well as ethanol and DDG prices dipped to four-month lows as fears of a global downturn due the corona virus were heightened this week. A Farm Futures survey released Thursday from 728 respondents estimated 96.6 million acres of corn for 2020. If true, this would be the second largest planting on record, following only 2012’s total of 97.3 million acres. As with any projection all of this “outlook” relies on the crop being planted in a timely fashion.

All of this bearish news here in the US comes as Brazilian farmers continue to plant their second crop corn. Domestic corn prices in Brazil are 20% higher than a year ago. Available corn supplies in Brazil are being priced at 45-50 Real per sack (approximately $5.00 to $5.50 per bushel). The main drivers behind this price strength are stronger livestock and ethanol demand as well as record Brazilian corn exports in 2019. Brazil’s second crop corn represents over 70% of the country’s corn production. The end of February marks the closing of the ideal planting window for second crop corn, but about 50% of the corn will be planted after February, which increases the risk factor for the crop.

Soybeans lower this week

May soybeans were 6-1/4 cents lower in the last trading week of February to close at 892-3/4. November soybeans were 9-1/4 cents lower to settle at 908-1/4. Both nearby and November soybean futures pushed into four-month lows this week. US export sales were extremely disappointing last week for soybeans, China bought only 72,000 tons. The bloodbath across all markets around the world lead soybeans lowers this week. Major markets around the world averaged more than 12% lower this week. Fears of lowered protein demand across the globe spooked buyers as front month soybeans trade nearly a dollar off of their recent highs. Soybean meal was about the only market sharply higher this week after the world’s largest soybean meal exporter, Argentina, announced export registrations would be suspended until further notice. Meal prices have been depressed for the last 18 months now. Managed money funds have pushed to a record short position in the soybean meal market in the last few weeks. Higher meal prices could be a possible catalyst to push soybean prices higher. The one bright spot for the soybean market this week was the downturn in the US dollar which sold off nearly 1% this week. The Brazilian Real, however, also traded lower keeping Brazilian beans more competitive in the world export market. Soybean harvest in Brazil was seen as 34% complete a week ago compared with 46% a year ago.

Chicago wheat moves sharply lower

May Chicago wheat prices were 27 cents lower this week to close at 525. KC May wheat was 22-1/4 cents lower this week, settling at 453-1/4. Minneapolis spring wheat on its May contract was 10-3/4 cents lower to close at 527-1/2. Wheat markets showed strength late in the session on Friday. After trading nearly 12 cents lower on front month Chicago wheat, the market rallied to close just two cents lower on the day. Rainfall over the central Plains growing areas weighed on wheat prices this week as well as the obvious coronavirus fears. Many wheat crops in Europe are emerging from dormancy more than one month ahead of normal which leaves them vulnerable to late winter frosts. The tightening ending stocks forecast for US wheat may provide some sort of underlying support, but the macro economic fears will be the dominate player in the near future.

Class III and Class IV Prices Bounce

The dairy spot markets were fairly mixed across the board today. The biggest event of the day was the fact that spot butter traded 39 loads, pushing 3 cents higher. It appears that, as we continue to push into the lowest prices since 2016, buyers are finding value here. Butter futures have moved lower a record 8 months in a row. Prices could be getting closer to a stronger recovery. Cheese and whey trade were fairly uneventful today with no loads trading in either market and whey pushing 0.25 cents higher. The non-fat powder market continues to be the laggard losing 1.50 cents on the day to bring the total losses for the week to 10.5 cents.

For the first time this week, we saw consistent bidding in the Class III and Class IV futures market. Prices pushed higher on what seems to be optimism that the butterfat complex could be turning around here. Additionally, the fact that some contracts have gotten close to the lowest prices they have traded offers support to the market. Going into next week there will be a GDT auction that could dictate the tone of our markets domestically. Non-fat and whole fat powder markets have been significantly lower in the last two auctions and they may need to see bidding pressure to help our non-fat powder prices domestically. GDT cheese made it over $2.00/lb last week and it would be supportive to see it maintain that level for the second auction in a row.