Corn moves lower as harvest progresses

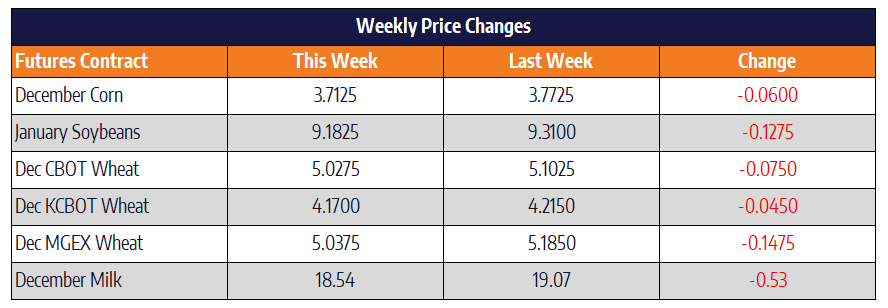

For the week, December corn was down 6 cents to close at 371-1/4, while July corn was down 7-1/4 cents to finish at 392-1/2. December of 2020 corn broke below the $4 mark this week and closed at 395-3/4. Corn harvest was seen as 66% complete as of Sunday vs 85% as the five-year average. December corn now sits in line with where it was prior to the near dollar rally we saw this spring.

With export demand for corn remaining weak, assistance from domestic demand will be needed to fill the void. Ethanol and feed, which accounts for nearly 75% of overall corn demand in this country, has seen an improving sentiment in the past few weeks. Ethanol profit margins for Iowa ethanol plants reached their highest level since August of 2018 this week. While front-month cattle prices are within spitting distance of their highs for the year. The implied strength in domestic demand paired with a delayed harvest is being reflected in better than usual basis across the country. Even with basis as strong as it is, the seasonality of basis would suggest an even further improvement as farmers begin to shut their bin doors with harvest wrapping up.

Soybeans lower on mixed China news

January Soybeans were down this week over 12 cents and closed the week at 918-1/4. July Soybeans closed at 952-1/2 down 13-1/2 cents on the week. Soybeans started the week off on a sour note and continued that weakness throughout the week. Geopolitical tensions between the U.S. and China were the major headlines contributing to the downward price action. Trade talks had reportedly hit a ‘snag’ early in the week over Chinese purchases of U.S. farm goods. But, a headline late in the day on Thursday signaled a more friendly tone hinting that the first phase of the deal was in its final stages.

Another factor adding pressure to the bean market is the progression of the South American crop. Soybean planting progress, which had started out behind pace, has caught up in recent weeks. Plantings in Mato Grosso and Parana, Brazil’s two largest soybean producing states, are now both above the 5-year average pace at 97% and 89% complete respectively as of last Friday.

Wheat lower for fourth straight week

December Chicago wheat was down 7-1/2 cents on the week to close at 502-3/4. Kansas City December wheat closed at 417 down 4-1/2 cents on the week. December Minneapolis Spring wheat was the loser of the week in the wheat complex setting back 14-3/4 cents to settle at 503-3/4. The Buenos Aires Grain Exchange again cut Argentina’s 19/20 wheat crop estimate. The current estimate as of Thursday is 18.5 million metric tonnes, this is down from last year’s record crop of 19.5 million metric tonnes. 2020 wheat acres are expected to be at an all-time low here in the states. Weakness in wheat prices in the last few years paired with a historically late harvest in 2019 are both contributing factors.

Spot Cheese Continues Lower But 2020 Futures Remain Positive

It has been a rough week for the spot cheese market as the block/barrel average lost another 2.25 cents after today’s trade. The spot cheese market dropped 12.875 cents on the week to settle at $2.0438/lb. The $2.00/lb level could offer some level of psychological support. If that doesn’t hold the 2018 high of $1.89625/lb could be the next level of technical support. Whey prices have been turning around this week as they gained 2.25 cents on 2 loads traded today. This is the first time in a month whey has been able to push above the $0.30/lb level. The next level of resistance for the whey market will be around $0.35/lb. Butter and powder prices were unchanged on the day but both were up on the week. Butter finished 3 cents higher and powder finished 1.25 cents higher.

The December Class III contract felt the pain of the recent cheese drop this week. The next level of support for the December contract should be around the $18.00 level. But the 2020 Class III average continues to advance to new highs. Today the 2020 average pushed up to $17.45 vs. the previous high of $17.40. This tells us that the market believes that 2020 futures have adequately priced in the recent drop in cheese prices. Lack of any meaningful trade in the Class IV products of powder and butter today left the market unchanged. 2020 contracts for Class IV milk have become fairly optimistic lately. They are currently pricing a Q3 and Q4 of 2020 average over $18.00.